Is Stock Investment in Korea for Foreigners still a bureaucratic nightmare? Not in 2026. For over 30 years, the South Korean stock market was guarded by a rigid wall known as the Investment Registration Certificate (IRC). But as of now, that wall has crumbled, opening a golden era for expat investors and global traders who want to own a piece of Korea’s “K-Economy” giants like Samsung Electronics, SK Hynix, and Hyundai Motors.

1 | The Death of IRC: A New Era for Expat Investors

The most significant change in 2026 for Stock Investment in Korea for Foreigners is the complete abolition of the mandatory IRC.

- What was the IRC? Since 1992, every foreign investor had to pre-register with the Financial Supervisory Service (FSS) to get a unique ID before buying a single share. This often took weeks and required notarized documents from your home country.

- The 2026 Standard: You can now open a brokerage account using just your Passport Number (for individuals) or Legal Entity Identifier (LEI) (for corporations).

- Why it Matters: The average monthly account opening for foreigners has skyrocketed from 105 in 2023 to over 400 in 2026, proving that the Korean market is now more accessible than ever.

2 | 2026 “Omnibus Account” System: Trade Without Limits

The second pillar of Stock Investment in Korea for Foreigners in 2026 is the expansion of Omnibus Accounts (통합계좌).

- Simplified Reporting: Previously, every end-investor needed their own separate account for every fund. Now, global asset managers can use a single integrated account to manage thousands of clients, drastically reducing administrative fees.

- English Disclosures: As of 2026, all KOSPI-listed companies with assets over 2 trillion KRW are legally required to provide English public disclosures. You no longer need to rely on Google Translate to understand audit reports or dividend declarations.

3 | Step-by-Step Guide: How to Start Investing Today

Follow this professional workflow to master Stock Investment in Korea for Foreigners with precision.

- Choose Your Brokerage: * Resident Foreigners (ARC Holders): You can use high-tech mobile apps from Mirae Asset, Shinhan Securities, or Samsung Securities. Many now offer full English UI and global trading capabilities.

- Non-Residents: You can appoint a “Standing Proxy” (usually a major bank) to handle orders and tax filings on your behalf.

- Submit Documentation:

- Passport: For individual identification.

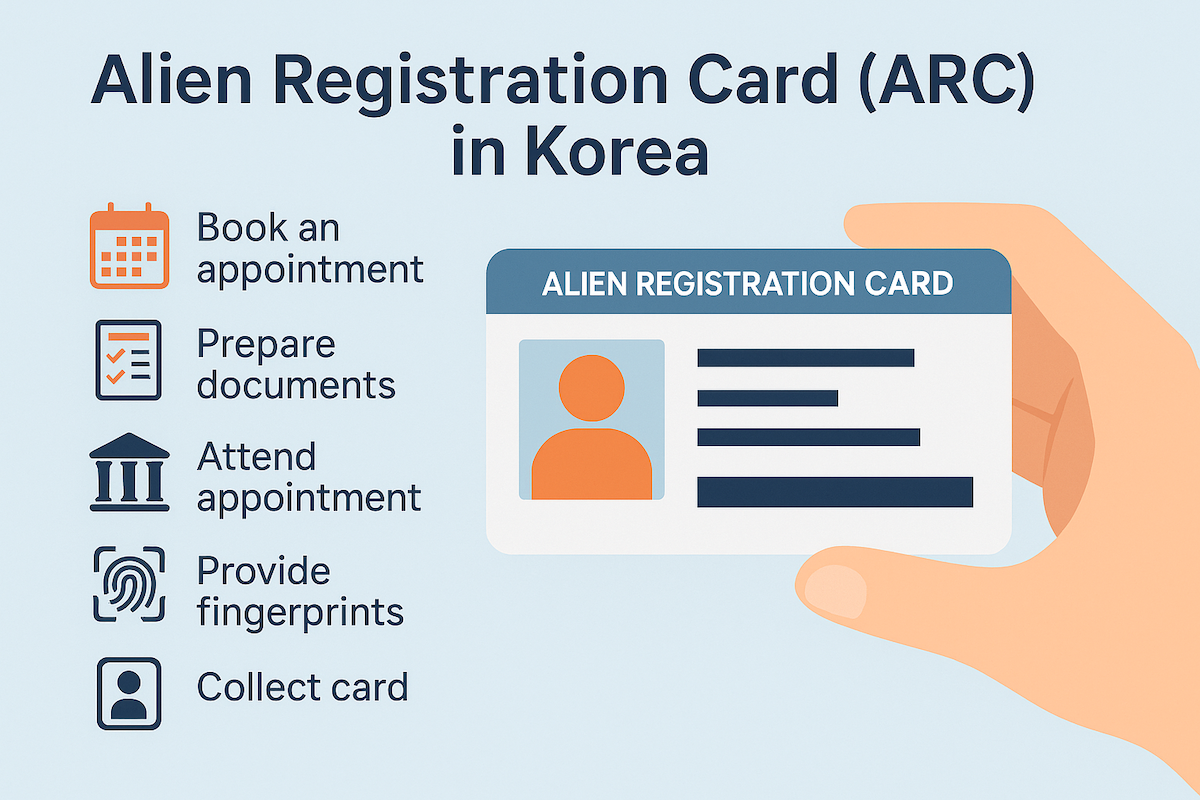

- ARC (If resident): To prove your domestic residency status for tax treaty purposes.

- Bank Account: Link your existing Korean bank account for seamless KRW transfers.

- Deposit “Good Faith” Money: Korean brokers often require a portion of the trade amount as a deposit (Evid-geum) at the time of the order.

4 | The 2026 App Ecosystem: Top Trading Tools

For a modern Stock Investment in Korea for Foreigners, choosing the right app is critical.

- StockPlus (by Dunamu): The trendy choice for social trading, integrating with KakaoTalk for real-time alerts and community insights.

- M-Stock (Mirae Asset): Known for having one of the most robust English interfaces for global users.

- Investing.com (Korea Edition): Essential for tracking real-time KOSPI/KOSDAQ data and economic calendars specific to South Korea.

5 | Strategic Advice: Taxes and Dividend Culture

To win at Stock Investment in Korea for Foreigners, you must understand the unique tax landscape.

- Dividend Taxes: Dividends are generally subject to a 22% withholding tax (including local tax), but this can be lower if your home country has a Tax Treaty with Korea.

- Capital Gains: While Korea has discussed capital gains taxes for years, in 2026, most retail investors remain exempt unless they are “Major Shareholders” holding more than 1 billion KRW in a single stock.

- WGBI Inclusion: Since April 2026, Korea has been added to the World Government Bond Index (WGBI), which is expected to bring over $50 billion into the local market, boosting overall liquidity and stability.