The Korea Banking ritual is a silent clash of cultures. Recently, while watching an expat on a TV show struggle to open a basic account, I was transported back to my own days in Australia. I remember the confusion of trying to navigate a banking environment that felt fundamentally “other” to what I knew.

In Korea, the efficiency is surgical, yet the institutional barriers for foreigners can feel like a labyrinth. As we transition through 2025 and into 2026, the landscape is shifting from physical card rituals to a digital-first era. This is not just about money; it’s about claiming your financial identity in the Land of the Morning Calm.

Table of Contents: The Financial Anatomy

- 1. The Cultural Collision: From Australia to the Korean Teller

- 2. The 2025 Digital Mandate: Mobile ARC and Instant Liquidity

- 3. The Big 4 Hierarchy: Choosing Your Financial Companion

- 4. Survival Mechanics: ATMs, Operating Hours, and the “Palli-Palli” Service

- 5. The Silent Barriers: Name Syncing and Hando-jehan Limits

- 6. Action Plan: Your Financial 정착 (Settlement) Strategy

1. The Cultural Collision: From Australia to the Korean Teller

In Australia, banking was often about the relationship—a slow conversation. In Korea, it is a high-speed ritual of “Palli-Palli” (hurry-hurry). Westerners are often stunned by the fragmentation of Korean branches, where “General Deposits” are strictly separated from “Loans/Credit” desks. This specialization is efficient for the bank but can feel cold and robotic to the uninitiated. Understanding that a Korean banker values speed and accuracy over small talk is the first step to mastering the Korea Banking experience.

2. The 2025 Digital Mandate: Mobile ARC and Instant Liquidity

March 21, 2025, marked a cinematic turning point for foreign residents. The introduction of the Mobile Alien Registration Card (ARC) finally filled the “financial vacuum” that used to last for weeks while waiting for a physical card.

- The Instant Ritual: With the Mobile ARC, expats can now open accounts and conduct transactions almost immediately upon arrival.

- Early Adopters: Jeonbuk Bank pioneered the same-day mobile opening, followed quickly by Shinhan and Hana in early 2025.

- The Strategic Impact: This digital leap significantly lowers the “settlement cost” for newcomers, allowing immediate access to essential economic tools.

3. The Big 4 Hierarchy: Choosing Your Financial Companion

Every major bank in Korea has a specific “flavor” or strategic focus for foreigners.

| Bank Name | Core Strength for Foreigners | Language Support (Apps) | Global Connectivity |

| Hana Bank | The FX Specialist (Hana EZ App) | Eng, Chi, Thai, etc. | Top-tier exchange rates and EZ-center rituals. |

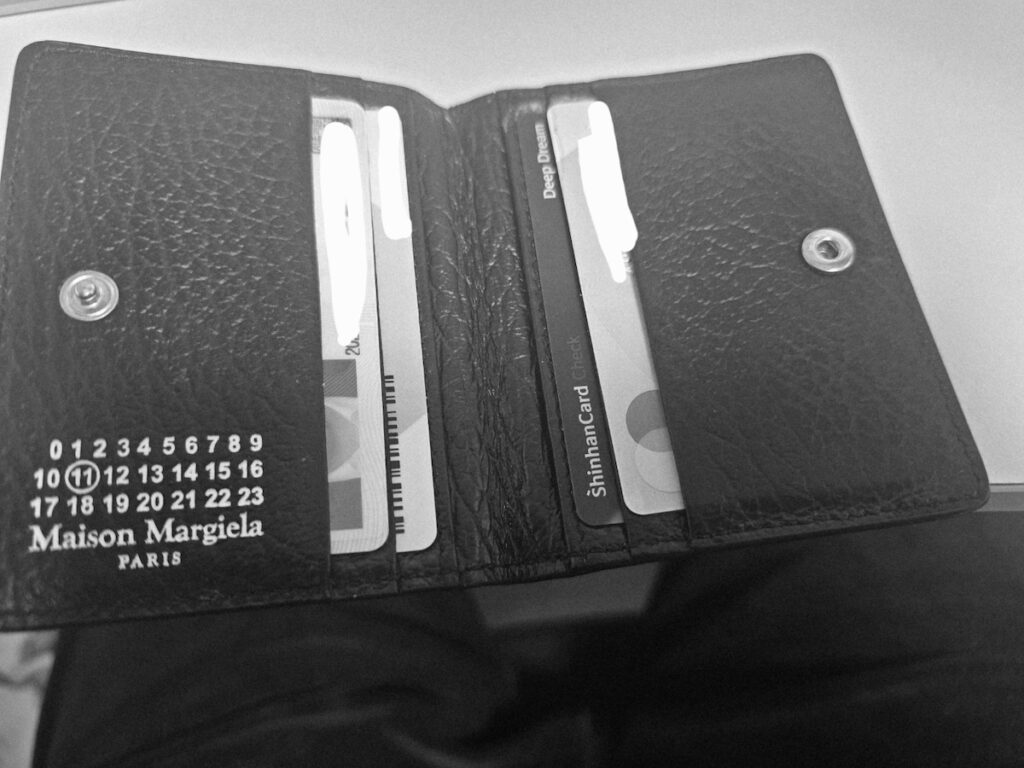

| Shinhan Bank | Digital Innovator (Global SOL App) | 16 Languages | Digital lounges and 50% FX discounts for SOL users. |

| Our (Woori) | Worker & Student Specialty | 8 Languages | Fee waivers for payroll transfers and Sunday operations. |

| KB Kookmin | Massive Accessibility & ATM Reach | Eng, Jap, Viet, etc. | Nationwide reach with the highest density of physical hubs. |

4. Survival Mechanics: ATMs, Operating Hours, and Sunday Rituals

The physical reality of Korea Banking involves rigid timeframes that contrast sharply with Western 24/7 expectations.

- The 4 PM Wall: Most branches close their doors at 16:00. For the working expat, this creates a desperate lunch-hour ritual to handle paperwork.

- Sunday Operations: Recognizing this struggle, Woori and Shinhan (as of July 2025) have opened Sunday branches in districts like Dongdaemun, Ansan, and Suwon.

- The ATM Fee Trap: Unlike many home countries where “your bank’s ATM” is always free, Korean machines often charge fees for “after-hours” use (usually after 6 PM), even for their own customers.

5. The Silent Barriers: Name Syncing and Hando-jehan Limits

The most sophisticated digital system can be defeated by a single character.

- The Name Ritual: If the name on your ARC, your phone contract, and your bank account do not match exactly—including spaces and capitalization—you will be locked out of the vital “Bon-in-in-jeung” identity verification system.

- Hando-jehan (The Ceiling): To prevent fraud, all new accounts are opened as “Limit-Restricted Accounts.” You may find yourself unable to transfer more than 300,000 KRW a day, which becomes a crisis when trying to pay a housing deposit.

- Lifting the Veil: You must present proof of employment or three months of utility bills to unlock your full financial power.

6. Action Plan: Your Financial 정착 (Settlement) Strategy

- Step 1: The Identity Ritual: Ensure your ARC name is in ALL CAPS and matches your mobile phone contract exactly.

- Step 2: Choose the Specialized App: Use Hana EZ if your primary goal is sending money home, or Shinhan Global SOL for the best multi-language daily banking.

- Step 3: Hunt for Sunday Hubs: If you work 9-to-6, save your complex banking tasks (like loans or card re-issuance) for a Sunday visit to an international branch in Ansan or Dongdaemun.

Related Guides: Mastering the Rituals of the Peninsula

If you are navigating the rapid transition of 2026 Seoul and beyond, these master guides provide the essential protocols for physical, digital, and financial survival.

1. Korea Banking: NH Bank vs Local Nonghyup – A Master Guide to Rural Finance Rituals

The “Shared Breath” of the Korean countryside is found in its green signboards. Before you settle in the provinces or attempt a rural transaction, you must decode the Nonghyup Paradox. Learn the 1st-tier vs. 2nd-tier legal divide, the secrets of account number middle digits, and the ARC Mandate that governs your financial liquidity.

2. Korea Travel: KTX & SRT Standing Ticket Ritual: 5 Tips to Survive a 400km Journey (2026)

When the seats are sold out and a family emergency demands a 400km dash to Mokpo, the “Standing Warrior” ritual begins. This guide reveals how to secure a 15% discount, win the silent battle for the Jump Seat, and navigate the “Door Protocol” at major stops like Busan or Daejeon.

3. Korea Travel: Gangnam Station Robot Server Guide: The Future of Dining

Experience the peak of Seoul’s AI-driven society in the heart of Gangnam. Witness how LiDAR-equipped robot servers are transforming the dining ritual, the generational wonder they inspire in children, and the digital divide they create for our elders. This is the future of the Korea Travel experience, rendered in high-tech cinematic detail.

7. Conclusion: The Zen of Financial Settlement

The Korea Banking ritual is a reflection of the nation itself—efficient, demanding, yet ultimately rewarding for those who master its cadence. Reflecting on my early days in Australia and the bewildered faces I still see on TV, I realize that the frustration of opening a Korean bank account is actually a “Rite of Passage.” It is the moment you transition from being a guest in this country to becoming a recognized participant in its digital heartbeat.

As we navigate through 2026, the barriers are becoming invisible and digital. The introduction of the Mobile ARC has eliminated the old “waiting ritual,” allowing for instant liquidity from the moment you land. However, the systemic nuances—the Hando-jehan limits and the strict Name Syncing protocols—remain as guardians of the system’s integrity.

To thrive financially in Korea, you must define your own ritual:

- The Strategic Choice: If you prioritize global movement and seamless remittance, the Hana EZ ritual is your companion.

- The Digital Native: If you seek the highest level of multi-language app sophistication, Shinhan’s Global SOL is your digital gateway.

- The Real-World Warrior: If your schedule only allows for weekend banking, the Sunday branches of Woori and Shinhan in hubs like Ansan or Dongdaemun are your sanctuaries.

Korea’s banking system is no longer inward-looking; it is a global-standard infrastructure optimized for the “Palli-Palli” speed of the future. Master the ARC mandate, respect the 4 PM wall, and align your identity across all digital platforms. Once you do, the labyrinth becomes a highway, and your financial life in Korea will breathe with the same cinematic energy as the city of Seoul itself.

🛡️ Final Action Plan: Your Banking Ritual Checklist

- Identity Lockdown: Ensure your name on your ARC, mobile phone, and bank application is identical (ALL CAPS, no stray spaces).

- Document Hierarchy: Carry your ARC and a “Certificate of Employment” to any branch visit to bypass the Hando-jehan (300,000 KRW) limit immediately.

- App Optimization: Download the Global version of your chosen bank’s app before your visit to ensure a smooth setup ritual with the teller.