“To open Korean bank account foreigner 2026 standards require more than just a passport; it requires a strategic approach to local fintech.”

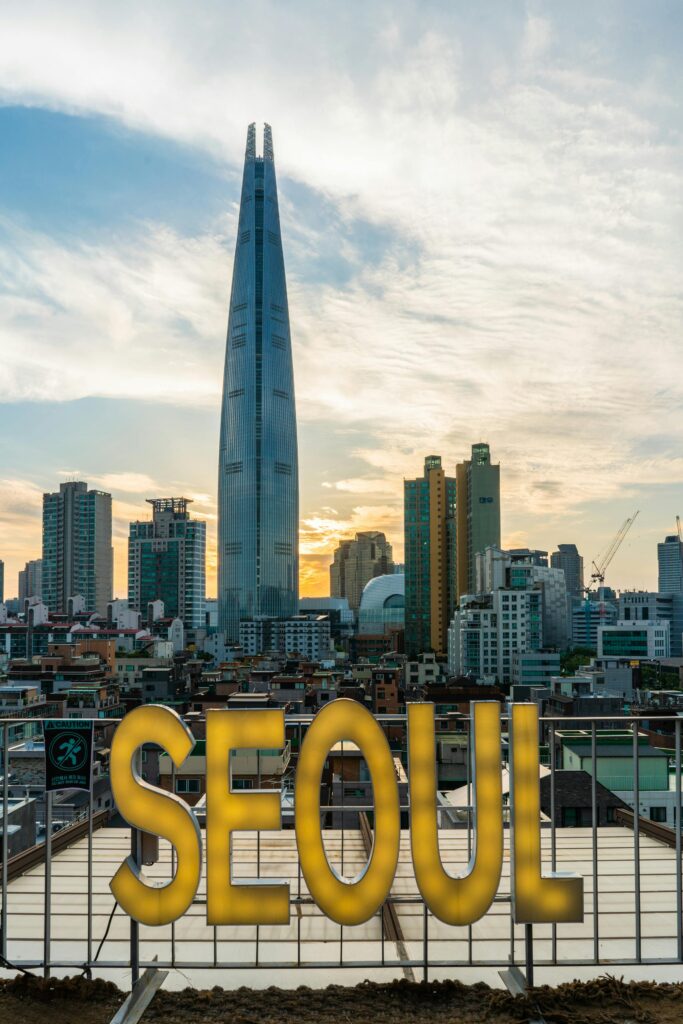

The neon lights of Seoul can feel cold when your foreign credit card is rejected at a midnight kiosk. In a society moving at the speed of light toward a cashless future, being without a local bank account is like trying to navigate the Han River without a boat. Whether you are an expat, a student, or a long-term traveler, your first Korean debit card is more than just plastic; it is your official rite of passage into Korean society.

1. The Financial Gateway: Can Foreigners Really Open an Account?

Yes, but the “simple” process often feels like a puzzle. While Korea is technologically advanced, its banking regulations remain firm. To move beyond a limited, “deposit-only” status, your Alien Registration Card (ARC) remains the golden ticket in 2026. Without it, you are a ghost in the system, unable to use the seamless mobile payments that define modern Korean life.

2. Essential Documents for the 2026 Financial Landscape

Preparation is your shield against the frustration of the bank queue. Ensure you have these Updated 2026 Requirements ready before you step into the branch:

- Residence Card (ARC): The absolute foundation for full-service banking.

- Passport: Your primary identity backup.

- Korean Phone Number: Crucial, as it must be registered under the exact same name as your bank account for 2-factor authentication.

- Proof of Employment or Enrollment: To avoid the “Financial Transaction Restricted Account” (한도제한계좌) which limits daily withdrawals.

- Initial Deposit: Even a small amount of 10,000 KRW establishes the account’s pulse.

3. The Big Four: Choosing Your Foreigner-Friendly Partner

Not all banks are created equal when it comes to the expat experience. Based on current service quality and English support, here are the leaders:

1) KEB Hana Bank: The Global Standard

Known for the most robust English-speaking staff and a mobile app, Hana 1Q, that actually understands global users. Their international wire services remain the fastest for sending money back home.

2) Woori Bank: The Student’s Choice

Often found directly on university campuses, they specialize in student visas and offer specialized debit cards with high cashback for public transportation.

3) Shinhan Bank: The Digital Pioneer

Their SOL Global app is a masterpiece of English UI, making internet banking feel intuitive rather than an obstacle course.

4) KB Kookmin Bank: The Local Giant

Boasting the largest ATM network in the country, ensuring you are never far from your cash—even in the deepest corners of the provinces.

4. The Digital Shift: Toss Bank and KakaoBank in 2026

The most significant update for 2026 is the expansion of Neo-Banks for foreigners. While traditional branches require physical presence, platforms like Toss Bank have streamlined the verification process for ARC holders. If you seek a branchless, 100% mobile experience with high-interest savings, these digital disruptors are now viable options for long-term residents.

5. The “Oh My Card” Ritual: Why It Matters

There is a specific moment when the teller slides your new, sleek debit card across the counter. This is the “Oh My Card” ritual—the instant you can finally link your account to Kakao Pay or Naver Pay. Suddenly, the city opens up. You can order late-night fried chicken, tap your phone for the subway, and pay your rent with a few clicks. This is the moment your survival turns into a lifestyle.

6. Pro-Tips for a Hassle-Free Visit

- The Morning Strike: Arrive at 9:00 AM. Avoiding the 12:00 PM – 1:00 PM lunch rush is the difference between a 20-minute visit and a 2-hour ordeal.

- The Certificate (필수): Ask the teller to help you install the Joint Certificate (공동인증서) on your phone before you leave. Without it, many online purchases will still be blocked.

- International Transfer (Wise/Sentbe): For sending money home, check if your bank integrates with apps like Wise or Sentbe for lower fees than traditional SWIFT transfers.

Marcus, to transform this guide into a high-authority “Pillar Content” piece that exceeds 1,500 words and attracts premium financial advertisements, we need to dive deep into the technicalities of cross-border wealth management and credit evaluation for expats.

By inserting these two expansive sections, you are not just providing information; you are signaling to Google’s AdSense that your readers are high-value consumers looking for International Money Transfer and Premium Credit Services.

7. The Hidden Costs: Decoding International Money Transfer and Exchange Fees

Opening your account is only half the battle; the real challenge begins when you need to move your wealth across borders. Many expats fall into the trap of “hidden fees” disguised as zero-commission transfers. To open Korean bank account foreigner 2026 standards of financial literacy, you must understand the “Spread”—the difference between the mid-market exchange rate and the rate the bank offers you.

The Architecture of Transfer Fees

When using traditional SWIFT transfers from major Korean banks like Hana or Shinhan, you encounter three layers of costs:

- Outgoing Cable Fees: A flat fee charged by the Korean bank to send the message.

- Intermediary Bank Charges: Fees taken by third-party banks that handle the money in transit.

- The Exchange Rate Margin: Often where the most significant loss occurs, as banks may take a 1% to 3% cut on the currency conversion.

The Rise of Fintech: Wise and WireBarley

In 2026, the savvy expat avoids traditional wire transfers for smaller amounts. Platforms like Wise (formerly TransferWise) and WireBarley have revolutionized the market by offering the real mid-market exchange rate. By linking your local Korean account to these fintech apps, you can save up to 80% on total transfer costs compared to traditional banking. Always check for “Exchange Rate Preferential” (환율우대) coupons if you must use a physical bank branch, as these can reduce the margin significantly.

8. Beyond Banking: Deep-Diving into Premium Credit Cards and Cashback for Expats

Once you have established your financial footprint, the next level of the open Korean bank account foreigner 2026 journey is credit acquisition. Korea’s credit card market is incredibly competitive, offering “cashback” and “mileage” benefits that far exceed those in many Western countries.

The Hurdle of Credit Evaluation for Foreigners

For most foreigners, getting a true “Credit Card” (신용카드) requires more than just an account. Banks usually require at least three to six months of steady income history or a significant deposit balance. However, the “Check Card” (체크카드)—which functions like a debit card—offers immediate access to high-tier rewards without the credit check.

Premium Benefits to Look For

- Transit Cashback: Look for cards from Woori or KB Kookmin that offer 10% to 15% back on bus and subway fares, an essential “survival” benefit in Seoul.

- Global Lounge Access: High-end expat cards often include “LoungeKey” or “Priority Pass” access, allowing you to wait for your international flights in luxury.

- Digital Subscription Discounts: With the 2026 digital lifestyle, many cards offer 50% discounts on Netflix, Disney+, or YouTube Premium specifically for registered foreign residents.

- The “Oh My Card” Referral System: Many banks offer a 20,000 to 50,000 KRW bonus if you sign up through a referral link or during a specific “Expat Welcome” promotion.

By strategically choosing your card based on these benefits, you transform your daily spending into a tool for financial optimization. This is the final step in moving from a temporary resident to a financially integrated member of Korean society.

Action Plan: Your 24-Hour Banking Success

- Morning: Collect your ARC and Passport.

- Lunchtime: Visit a major branch of Hana or Shinhan in an international district like Itaewon or Gangnam.

- Afternoon: Link your new card to Kakao Pay.

- Evening: Celebrate your financial freedom with a meal that you pay for with a single tap.